Sluggish sales and rising inventories see Fraser Valley moving toward a buyer’s market

October 4, 2024

SURREY, BC — With active inventories hitting levels not seen in 10 years and sales 30 per cent below the 10- year average, Fraser Valley real estate is building towards a buyer’s market if sales continue to lag.

The Fraser Valley Real Estate Board recorded 982 sales in September, down by eight per cent over August and by more than 10 per cent over September 2023. Again, seasonally adjusted sales were the second slowest in a decade in the Fraser Valley

“With three rate cuts already and more expected before the end of the year, buyers are watching the market closely to time their purchasing decisions,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “The current conditions should favour buyers, particularly in the detached market, however until we start to see some movement in asking prices, properties will continue to sit on the market for extended periods as both buyers and sellers await the next rate announcement.”

New listings rose in September, up 21 per cent to 3,352, an increase of 17 per cent year-over-year. Overall inventory increased five per cent from August to September to 9,045, up 39 per cent over last year. The combination of declining sales and rising inventories has helped to create balanced, and in some cases, buyers’, market conditions in the Fraser Valley.

“We know the demand is there among Fraser Valley buyers,” said Baldev Gill, CEO of the Fraser Valley Real Estate Board. “After months on the sidelines, buyers want to get into the market but many also need to sell before they can buy. When you factor in affordability challenges and the anticipation of more interest rate cuts, we are seeing persistent weakness in the market. In conditions like these, we encourage buyers and sellers alike to talk to their REALTOR® to assess the risks and opportunities before making a decision.”

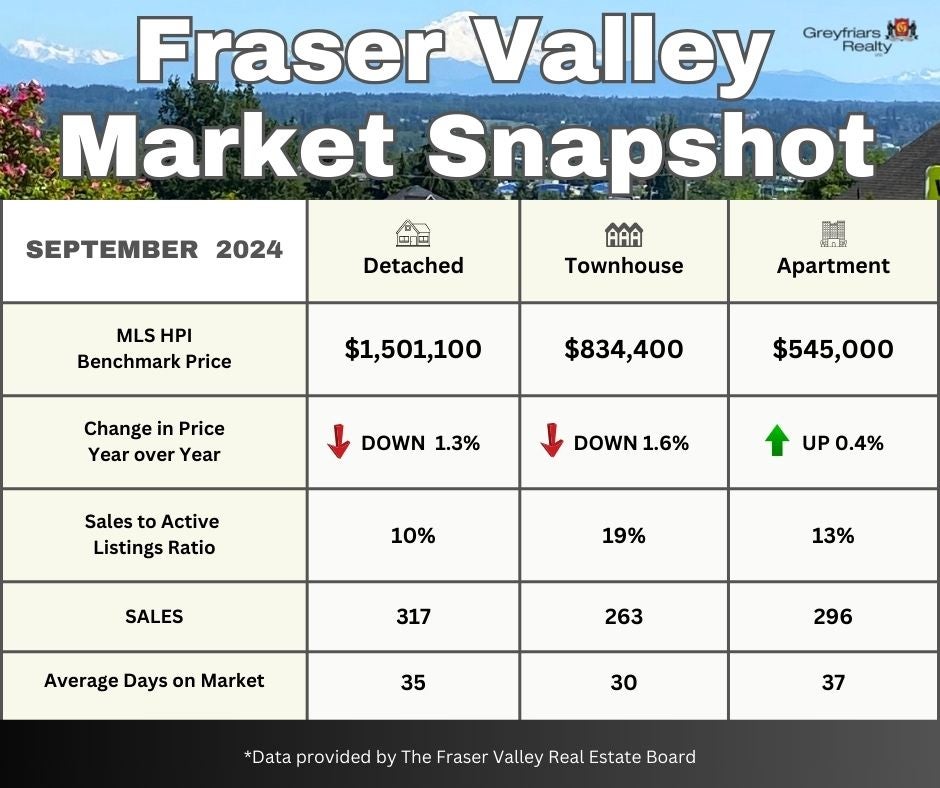

Across the Fraser Valley in September, the average number of days to sell a single-family detached home was 35, while for a condo it was 37. Townhomes took, on average, 30 days to sell.

Benchmark prices in the Fraser Valley dipped again in September, with the composite Benchmark price down 1.4 per cent to $978,800.

MLS® HPI Benchmark Price Activity

Single Family Detached: At $1,501,100, the Benchmark price for an FVREB single-family detached home decreased 1.5 per cent compared to August 2024 and decreased 1.3 per cent compared to September 2023.

Townhomes: At $834,400, the Benchmark price for an FVREB townhome decreased 1.4 per cent compared to August 2024 and decreased 1.6 per cent compared to September 2023.

Apartments: At $545,000, the Benchmark price for an FVREB apartment/condo decreased 0.2 per cent compared to August 2024 and increased 0.4 per cent compared to September 2023.

To view the complete package:

Before You Make a Move:

Weighing it all Out

Deciding when to move can be a tough decision. If you are thinking about moving, consider the following:

Deciding when to move can be a tough decision. If you are thinking about moving, consider the following:

Length of time living in your next home Would you be there long enough to recoup the initial costs of moving, such as the down payment, closing fees, and moving expenses?

Mortgage penalties Try to align selling with when your mortgage is up for renewal to avoid a penalty, or negotiate it with your lender. You may also have the option to port your mortgage and take on a blended rate combining your old interest rate with the new one.

Your job situation If you don’t have a secure job this could be an obstacle with a lender.

Non-monetary costs Would you be moving mid-way through your child’s school year, or would they have to give up the sports team they are on if you moved? Consider disruptions to your routine and social connections, along with other stresses in your life, to determine if it’s the best time to move.

Plans for the new home Do you have plans for what you would want to do with your new home, and might there be any restrictions on what you can do (e.g. do you intend to renovate it, run a business out of it, or use it as a short-term rental)?

Your future plans If you don’t have a secure job this could be an obstacle with a lender.

Your day-to-day life Consider the neighbourhood you would want to live in, the monthly bills, and the lifestyle you would like to have.

If moving is on your mind and you are looking for advice to help with your decision, remember we're always happy to help. Call or email today 604-309-5453 or email: bonetti@telus.net

Check out our next ad in the Langley Advance Times :

Setting the Mood With Colour: Home Buyer Psychology

When selling your home, it’s helpful to consider the effects colour could have on potential buyers. Here are some tips to consider when choosing colours:

Neutrals

Some of the colours that fall under this category include shades of white, grey, and brown. They promote feelings of calmness, clarity, peace, and cleanliness. White also complements any style and works well as a blank canvas to express your style through other furnishings. Neutrals look nice with shifting light, so they are good for rooms during the day, and also can be good for a calming effect in bedrooms.

Pastels

Light shades of purple, pink, blue, and green are just some examples of pastel colours that work nicely in a home. The light, airy quality of pastels is thought to lift spirits, and like neutrals, these colours can also promote relaxation. Pastels can also enhance other colours and encourage expression.

Deep Shades

Dark, bold colours can add drama to a room, and fill it with energy, creativity, and confidence. Dark purple and blue, black, and red, are just some examples of deep colours. These rich colours can also work well on an accent wall for dramatic effect. Since they raise energy levels, they are best used in daytime areas like dining and living areas, kitchens, and entryways, and should be avoided in places meant for sleep or relaxation like bedrooms.

Of course, the impact of colour on feelings is generalized. Not everyone will feel the same about a certain colour since the feeling evoked by a particular colour will vary from person to person.

Recent Blog Entries

Just Listed- 1 Bed/ 1 Bath Condo in Abbotsford's Tamarind

(Sep 27, 2024)

Just Listed in Strawberry Hills- 4 Bed/ 3 Bath on flat, useable 1.1 ACRE

(Sep 09, 2024)

The Bank of Canada lowers key interest rate to 4.25%

(Sep 04, 2024)

"Autumn teaches us the beauty of letting go. Growth requires release- its what the trees do" ~Ka'ala

NEW PRICE!

REAL ESTATE NEWS

The Bank of Canada lowers key interest to 4.25%

The Bank of Canada lowered the interest rate again by 25 basis points to 4.25%, its third consecutive rate cut this year, which is expected to be an immediate relief to debt carrying Canadians with variable rates of interest, which includes some home equity lines of credit and mortgages.

"If inflation continues to ease broadly in line with our July forecast, it is reasonable to expect further cuts in our policy interest rate," said Bank of Canada governor Tiff Macklem, "With inflation getting closer to the target, we need to increasingly guard against the risk that the economy is too week and inflation falls too much"

Inflation cooled to 2.5% in July and economists predict two more 25-basis-point interest rate cuts for the Bank of Canada's remaining decisions in 2024, en route to a 2.5% policy rate in 2025.

The Bank of Canada's next interest rate decision comes on October 23, 2024

To read the full article:

For any questions you may have on the latest news and how it effects you, give us a call at 604-309-5453

Upsizing or Downsizing? Don't Overdo It!

Imagine you have a growing family, and you want to trade in the small sedan for something larger. So, you visit the dealership and come back with a bus.

Well, that would be upsizing a bit too much – unless you have a really huge family!

That’s the challenge of upsizing or downsizing. You need to be careful not to take it too far and end up with something that isn’t suitable. This often occurs in the real estate world.

For example, homeowners might decide to sell their home and find a smaller one. But, if they go too far, they end up with a property so small they feel claustrophobic. How do you avoid a similar scenario happening to you?

If you’re thinking of upsizing or downsizing, the best place to start is in your own home. Think about how you use the space. Do you and your family spend a lot of time in certain areas? Are there rooms and other spaces that are rarely used? Or, conversely, do you wish you had more room — such as an extra bedroom, wider driveway, separate living and family rooms, etc.?

Do a thoughtful analysis of how you’re using your current property in order to reveal clues about what you’ll want in your next home. If you’re upsizing, you might find that all you need is an extra bedroom. If you’re downsizing, you might realize that one family room, rather than separate living and family rooms, would work better for you.

So, whether you’re upsizing or downsizing, carefully decide what type of new home you need. Be as specific as possible. Consider criteria such as the number of bedrooms, entertaining space, bathrooms, driveway size, etc., that you need. Doing that will help ensure your upsizing or downsizing move will be successful.

I can help you make an informed decision.

Call today. 604-309-5453

Get to Know...

Joanne Bonetti

Joanne's formal education and training allows her to excel at every step of the real estate selling or buying process.

Joanne has always lived in the Langley area and is very knowledgeable of the Fraser Valley market.

Choosing a Real Estate Career over 15 years ago, she has seen the many changes this industry has had. Following the trends and staying informed is crucial to this business.

Outside of her career in real estate, Joanne enjoys an active lifestyle with crossfit, neighbourhood walks and spending time with family and friends.

Known by clients and colleagues for her honesty, dedication and reliability, Joanne also has a reputation for timely and focused responses to each of her client’s needs and concerns. She is a skilled negotiator and goes the extra mile for her clients. Always included is quality after-care from start to finish.

A Full-time Realtor who is committed to providing expertise tailored to your needs and learning what is important to you to reach your real estate goals, Joanne is a clear choice for anyone thinking of buying or selling their home.

A big Thank you to all her clients, friends, and family for their continued support.

Proud Supporter of the BC Cancer Foundation